The cidaas ID validator as part of the

Schufa myConnect-Hub

Customized solutions to identify your customers.

With the cidaas ID validator cidaas offers an AutoIdent procedure that enables a unique user identification and highest security across all channels – for an AMLA compliant identification procedure in accordance with § 12 (1) no. 3 in conjunction with sentence 3 AMLA, which is available via SCHUFA’s myConnect hub.

Do you want to identify your customers online in a way that meets regulatory requirements and security standards? Do you find conventional identification procedures expensive and they demand many complex applications from you?

That doesn’t have to be the case, because SCHUFA’s myConnect-Hub provides you with a user-friendly overall solution that combines all the necessary services for AMLA-compliant identification in accordance with Section 12 (1) No. 3 in conjunction with sentence 3 of the AMLA. This means: identification and contract conclusion in one. An eIDAS-compliant qualified electronic signature (QeS) can be offered on the basis of the cidaas ID validator.

SCHUFA’s myConnect hub thus focuses on user-friendliness together with security and cidaas is a crucial part of this with the cidaas ID validator.

In combination with the cidaas ID validator, the reference transfer from finAPI and the Qualified Electronic Signature (QES) from Bank-Verlag, myConnect-Hubs enables a completely digital contract conclusion.

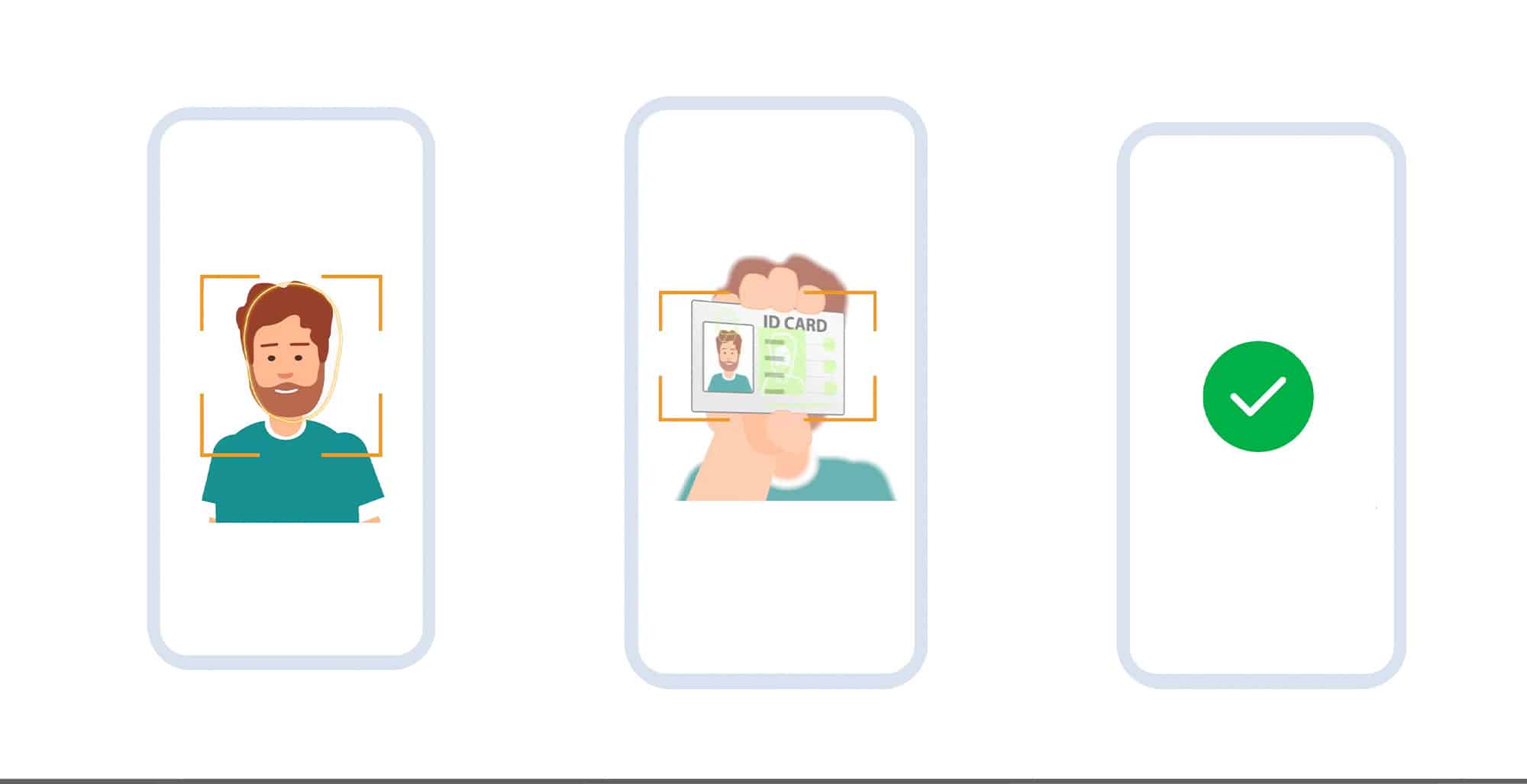

AutoIdent procedure

with cidaas

Reference transfer

with finAPI

Digital signature (QeS) with the bank publisher

This reliable identification meets the specific industry-specific regulatory requirements of the financial, insurance and telecommunications sectors. This allows you to fulfill the processes for digital identification and contract signing in a single solution, enabling you to complete tasks such as concluding loan agreements or opening bank accounts quickly and in accordance with legal requirements.

The cidaas ID validator provides a fully digital AutoIdent process solution that offers the highest customer experience. This solution from cidaas guides users intuitively through an automated identity verification process that is based solely on video technology and therefore does not require a real person for verification.

The SCHUFA myConnect hub in 3 simple steps:

All partners of the AMLA-compliant procedure are German companies, which means that for the first time a QeS-based AMLA-compliant ID procedure “Made in Germany” has been created.

cidaas, as a leading provider of Identity & Access Management solutions is part of the SCHUFA myConnect-Hub, with the goal to revolutionize the onboarding and identity verification of your customers in an eIDAS compliant way. Verified identities form the basis for many business models in various industries and are not only important in the context of legal requirements in the area of online identity verification.

Requirements to cidaas

A simple & secure verification of identity documents

Real-time verification & data reconciliation

Comprehensive reporting for reliable review of verification attempts

Digital contracting with qualified signature and fulfillment of the highest security and compliance requirements

A GDPR and eIDAS compliant solution

Benefits of the cidaas ID validator

User-friendly identity verification in real time from a wide range of identity documents for an optimal customer journey

Fully automated video-based legitimation without interaction with an agent

Liveness & Deep Fake detection for the detection of manipulated documents or videos

A simple and fast user administration and authorization management

Identity verification is often associated with specific processes such as opening an account or signing a credit agreement. But the potential applications extend far beyond these obvious examples. Verified identities form the basis for many business models in various industries and are not only important in the context of legal regulations in the field of online identity verification. For example, the cidaas ID validator can also be crucial when renting rental cars or in e-commerce when purchasing age-restricted products.

“As a secure, innovative identification method, the AutoIdent process is a reliable alternative to other identification methods and can be used in a wide range of applications – without an app download and “Made in Germany”!”

Stephan Peters

Identity and Fraud Prevention Expert, SCHUFA Holding AG

Digital identity verification with cidaas

eIDAS 2.0 – the future of digital identity in Europe